Stony Brook SBDC

Please Understand The Economic Injury Disaster Loan Program will have inherent

delays in processing applications and is not a quick process. As our business

advisors will assist our clients in understanding the application process, please be

aware of potential time constraints and delays that may occur.

SBA Announced they are experiencing high volumes of traffic and the site may be slow. Non-peak hours are

7:00PM-7:00AM EDT. Some users are experiencing issues using Chrome.

Please use an alternate browser - like Edge or Internet Explorer.

SBA Disaster Assistance in Response to the Corona virus

Economic Injury Disaster Loan Program

The Stony Brook SBDC is one of the SBA's designated Partners to provide support services

for this effort. For more information and guidance in submitting your application, please

contact us by Clicking Here

Click Here To make an online appointment with one of our Business Advisors

Key points about Disaster Relief due to Coronavirus

https://www.sba.gov/funding-programs/disaster-assistance

• The U.S. Small Business Administration is offering designated states and territories low-interest

federal disaster loans for working capital to small businesses suffering substantial economic injury

as a result of the Coronavirus (COVID-19).

• Eligibility- The applicant must be physically located in a declared county and suffered working

capital losses due to the declared disaster, not due to a downturn in the economy or other reasons.

Examples of eligible industries include but are not limited to the following: hotels, recreational

facilities, charter boats, manufacturers, sports vendors, owners of rental property, restaurants,

restaurants, retailers, souvenir shops, travel agencies, and wholesalers.

• SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance per small business and

can provide vital economic support to small businesses to help overcome the temporary loss of

revenue they are experiencing.

• These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be

paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit

available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate

for non-profits is 2.75%.

• SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of

30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

• Criteria for a loan approval

Credit History- Applicants must have a credit history acceptable to SBA.

Repayment- SBA must determine that the applicant business has the ability to repay the SBA loan.

• Collateral requirements

-Economic Injury Disaster Loans over $25,000 require collateral which means the maximum unsecured loan amount is $25,000.

-SBA takes real estate as collateral when it is available.

-SBA will not decline a loan for lack of collateral, but requires borrowers to pledge what is available.

• Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster, but the loans cannot be consolidated.

• The Application Process – What documentation is needed:

-Completed SBA loan application (SBA Form 5 or 5C)

-Tax Information Authorization (IRS Form 4506T)

-Complete copies of the most recent Federal Income Tax Return.

-Schedule of Liabilities (SBA Form 2202).

-Personal Financial Statement (SBA Form 413).

-Other information may also be requested.

• How to Apply – Disasterloan.sba.gov

Although a paper application and forms are acceptable, filing electronically is faster and more accurate.

There is no cost to apply and there is no obligation to take the loan if offered.

The biggest reason for delays in processing the disaster loan application is due to missing or incomplete information.

Make an appointment with a Business Advisor to avoid this most common mistake.

• Visit SBA.gov/disaster for more information.

U.S SMALL BUSINESS ADMINISTRATION

FACT SHEET - ECONOMIC INJURY DISASTER LOANS

NEW YORK Declaration 16346

(Disaster: NY-00197)

Incident: CORONAVIRUS (COVID-19) occurring: January 31, 2020 & continuing

All counties within the State of New York; the contiguous Connecticut counties of: Fairfield

and Litchfield; the contiguous Massachusetts county of: Berkshire; the contiguous New Jersey counties of:

Bergen, Hudson, Passaic and Sussex; the contiguous Pennsylvania counties of: Bradford, Erie, McKean,

Pike, Potter, Susquehanna, Tioga, Warren and Wayne; and the contiguous Vermont counties of: Addison,

Bennington, Chittenden, Grand Isle and Rutland

Application Filing Deadline: December 21, 2020

Disaster Loan Assistance Available:

Economic Injury Disaster Loans (EIDLs) – Working capital loans to help small businesses, small agricultural

cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes

meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster.

These loans are intended to assist through the disaster recovery period.

Credit Requirements:

Credit History – Applicants must have a credit history acceptable to SBA.

Repayment – Applicants must show the ability to repay the loan.

Collateral – Collateral is required for all EIDL loans over $25,000. SBA takes real estate as collateral when it is available.

SBA will not decline a loan for lack of collateral, but SBA will require the borrower to pledge collateral that is available.

Interest Rates:

The interest rate is determined by formulas set by law and is fixed for the life of the loan. The maximum

interest rate for this program is 3.750 percent.

Loan Terms:

The law authorizes loan terms up to a maximum of 30 years. SBA will determine an appropriate installment

payment based on the financial condition of each borrower, which in turn will determine the loan term.

Loan Amount Limit:

The law limits EIDLs to $2,000,000 for alleviating economic injury caused by the disaster. The actual amount

of each loan is limited to the economic injury determined by SBA, less business interruption insurance and

other recoveries up to the administrative lending limit. SBA also considers potential contributions that are

available from the business and/or its owner(s) or affiliates. If a business is a major source of employment,

SBA has the authority to waive the $2,000,000 statutory limit.

Loan Eligibility Restrictions:

Noncompliance – Applicants who have not complied with the terms of previous SBA loans may not be

eligible. This includes borrowers who did not maintain required flood insurance and/or hazard insurance on previous SBA loans.

Note: Loan applicants should check with agencies / organizations administering any grant or other assistance

program under this declaration to determine how an approval of SBA disaster loan might affect their eligibility.

Refinancing:

Economic injury disaster loans cannot be used to refinance long term debts.

Insurance Requirements:

To protect each borrower and the Agency, SBA may require you to obtain and maintain appropriate

insurance. By law, borrowers whose damaged or collateral property is located in a special flood hazard area

must purchase and maintain flood insurance. SBA requires that flood insurance coverage be the lesser of

1) the total of the disaster loan, 2) the insurable value of the property, or 3) the maximum insurance available.

Applicants may apply online, receive additional disaster assistance information and download applications at

https://disasterloan.sba.gov/ela. Applicants may also call SBA’s Customer Service Center at (800) 659-2955

or emaildisastercustomerservice@sba.gov for more information on SBA disaster assistance. Individuals who are

deaf or hard-of-hearing may call (800) 877-8339. Completed applications should be mailed to U.S. Small

Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

H.R.6201, FAMILIES FIRST CORONA VIRUS RESPONSE ACT

The legislation provides paid leave, establishes free testing, protects public health

workers, and provides important benefits to children and families.

NY DoL Shared Work Program applications available:

The program allows employees on a reduced schedule to collect unemployment for days not

worked helping to offset reduced incomes. NY is apparently moving much more quickly than

other states and the program is a great way to help reduce expenses while retaining

employees. For more information visit

https://www.labor.ny.gov/ui/employerinfo/shared-work-program.shtm

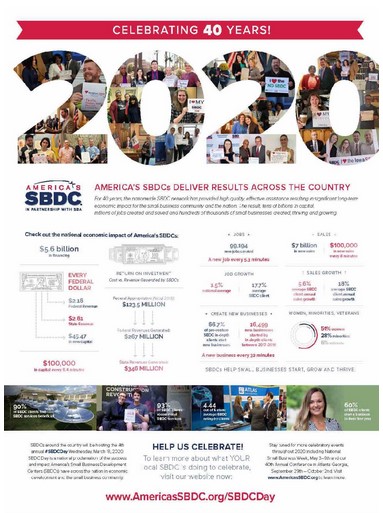

America's SBDC's Have Been Helping Small

Businesses for 40 Years!!